cash flow from assets is defined as

Athe cash flow to shareholders minus the cash flow to creditors. This refers to the net cash generated from a companys investment-related activities such as investments in securities the purchase of physical assets like equipment or property or the sale of assets.

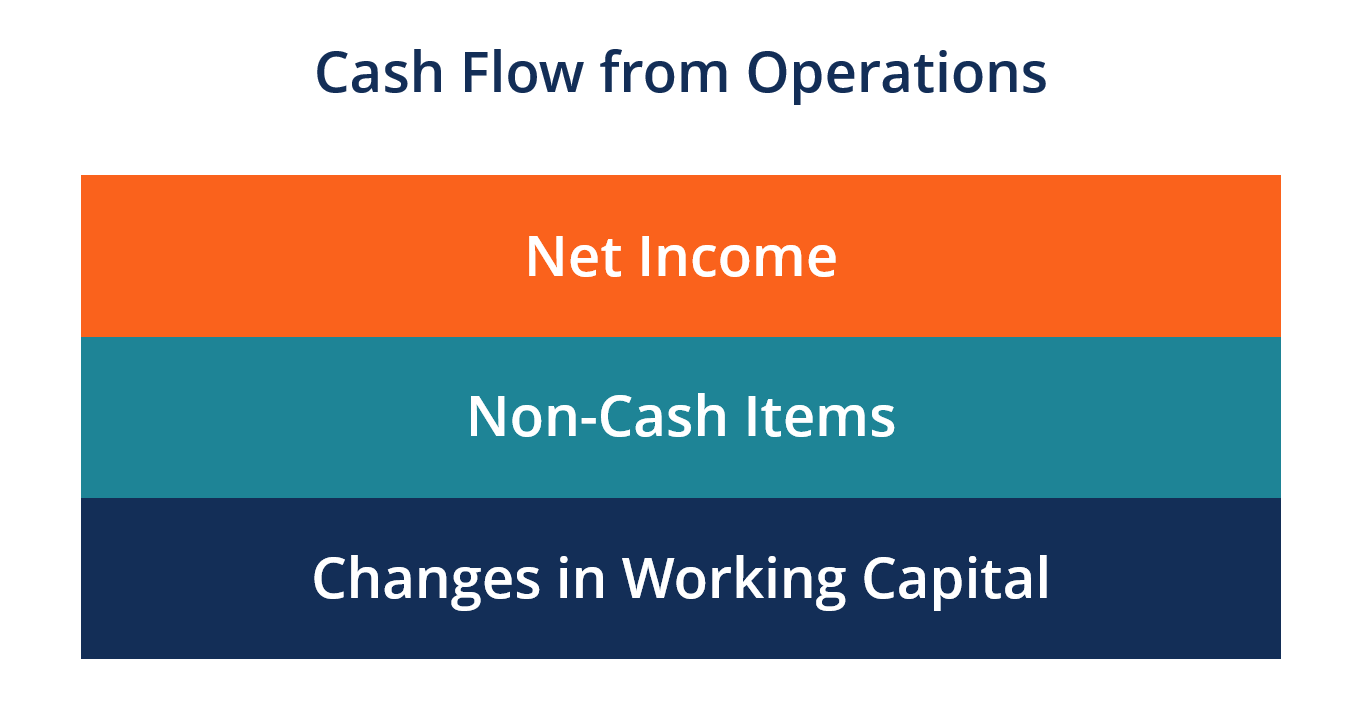

Based from its formula it can be defined that the cash flow from assets is the operating cash flow minus the change in net working capital minus net capital spending.

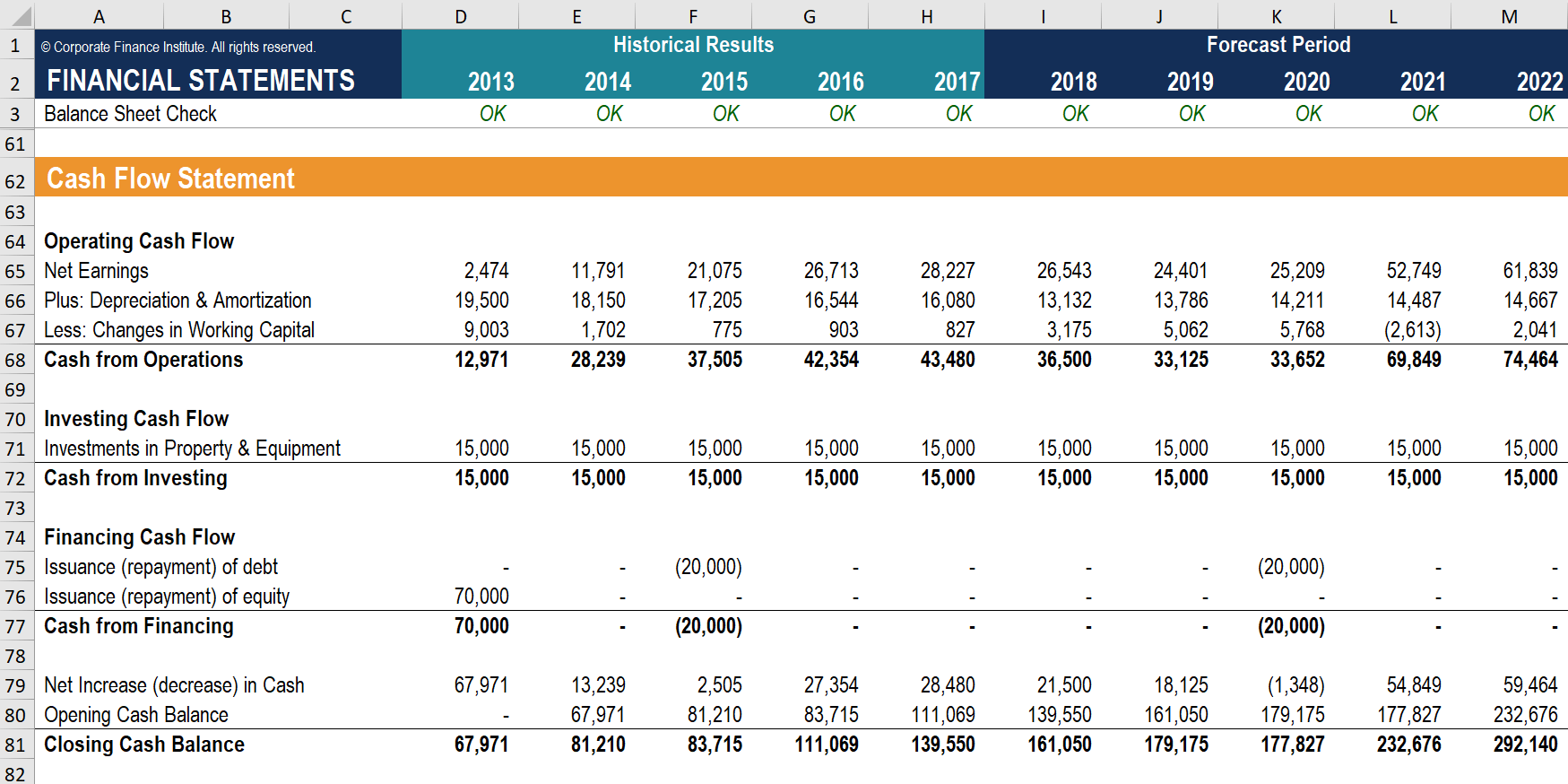

. The cash flow on total assets ratio is calculated by dividing cash flows from operations by. Investing cash flow. It determines how much cash a business uses for its operations with a specific period of time.

Boperating cash flow plus the cash flow to creditors plus the cash flow to shareholders. We use an interactive model. Cash flow from assets is the aggregate total of all cash flows related to the assets of a business.

That represents the amount of cash a company generates or consumes from carrying out its operating activities over a period of time. Cash flow from assets is defined as a the cash flow. Interest paid plus net new borrowing.

Operating cash flow minus the change in net working. In healthy companies that are actively investing in their businesses this number will often be in the negative. Cash Flow From Assets.

In finance the term is used to describe the amount of cash currency that is generated or consumed in a given time period. Current assets such as intangible assets stock in legible entities and future contracts can all be valuable resources to keep a steady and growing cash flow. Tap card to see definition.

N net capital spending. Defined benefit pension schemes create two leverage effects - financial leverage due to the debt like nature of pension deficits and asset allocation leverage if pension assets are not matched with pension liabilities. Cash flow from assets refers to a businesss total cash from all of its assets.

Cash flow from assets can be defined as. The cash flow to shareholders minus the cash flow to creditors. What is Cash Flow from Assets.

Coperating cash flow minus the change in net working capital minus net capital spending. The cash flow to shareholders minus the cash flow to creditors. Auf Basis des Free Cash Flow kann weiterhin der Wert einer Finanzanlage kalkuliert werden.

Click card to see definition. Operating activities include generating revenue. W changes in net working capital.

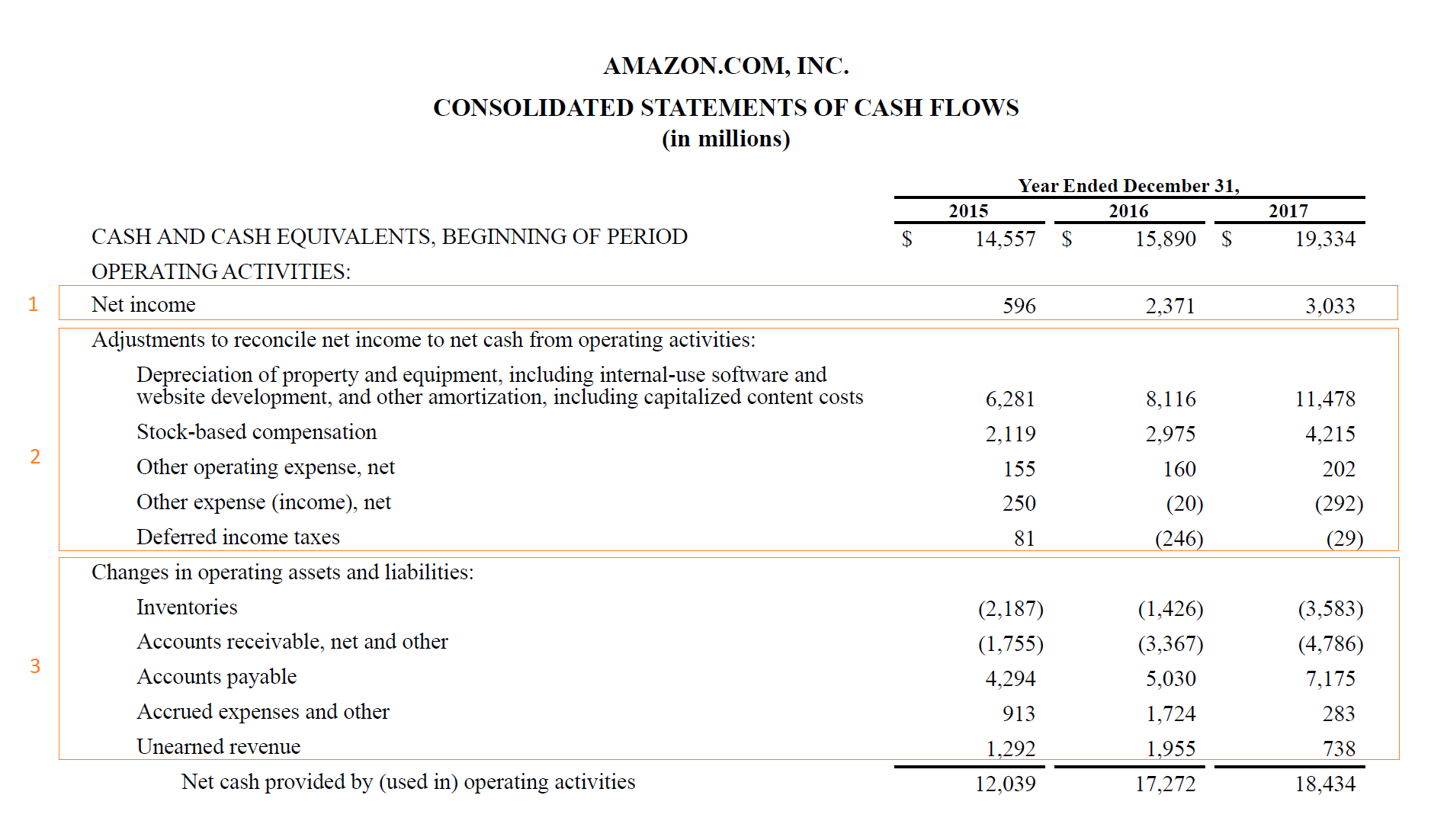

So for US we have. Cash flow from assets is defined as. From the cash flow identity above this 87 cash flow from assets equals the sum of the firms cash flow to creditors and its cash flow to stockholders.

Up to 24 cash back The total cash flow from assets is given by operating cash flow less the amounts invested in fixed assets and net working capital. Cash flows from investing activities provide an account of cash used in the purchase of non-current assetsor long-term assets. Cash flow is the net amount of cash that an entity receives and disburses during a period of time.

A positive level of cash flow must be maintained for an entity to remain in business while positive cash flows are also needed to generate value for investors. Operating cash flow minus net capital spendings minus the change in net working capital. The cash flow from assets has the formula.

However it does not factor in money from other financing sources such as selling stocks or debts to offset negative cash flow from assets. The concept is comprised of the following three types of cash flows. Cash flow from assets is defined as.

This information is used to determine the net amount of cash being spun off by or used in the operations of a business. Hence the answer is C. There are many types of CF with various important uses for running a business and performing financial analysis.

Cash flow is the net amount of cash and cash equivalents being transferred into and out of a business. Cash Flow to Creditors Cash Flow to Stockholders Click again to see term. Cash flow to creditors is defined as.

Cash flow from assets is defined as. Cash Flow CF is the increase or decrease in the amount of money a business institution or individual has. Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period.

Cash flow generated by operations. The cash flow from investing section shows the cash used to purchase fixed and long-term assets such as plant property and equipment PPE as well as any proceeds from the sale of these assets. In DCF valuation these effects must be correctly and consistently included in both the discount rate and free cash flow.

Operating cash flow plus the cash flow to creditors plus the cash flow to shareholders. Financing Wise financing decisions that allow you to invest in better equipment or work with affiliated entities can definitely give your company a leg up. Interest paid plus new net borrowing.

Operating cash flow plus the cash flow to creditors plus the cash flow to. Dies geschieht indem die zukünftig aus dieser Investition erwarteten Auszahlungen ZinsenDividenden und Verkaufswert der Assets mittels des sogenannten Discounted Cash Flow-Verfahrens DCF mit einem risikoadäquaten Zinssatz abgezinst wird. Cash from assets plus net new equity.

Dividends paid plus net new borrowing. Interest paid minus net new borrowing. Cash flow on total assets is an efficiency ratio that rates actually cash flows to the company assets without being affected by income recognition or income measurements.

Doperating cash flow plus net capital spending plus the change in net. Cash flow to shareholders minus net capital spending minus the change in net working capital. Net capital spending plus the change in net working capital.

F operating cash flow.

Book Value Can Mean Various Things To Various People For Instance Book Value On The Invest Pedia Blog At The Ti Meant To Be Accounting And Finance Investing

How Do Net Income And Operating Cash Flow Differ

Cash Flow From Operations Definition Formula And Example

Cash Flow Statement Meaning 3 Components Examples

Cash Flow From Operations Definition Formula And Example

Amalgamation Vs Merger Money Management Advice Learn Accounting Economics Lessons

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

Cash Flow From Operations Definition Formula And Example

Cash Flow Statement Definition Example And Complete Guide Fourweekmba

Cash Flow Forecast Template For Ms Excel Excel Templates Cash Flow Statement Cash Management Cash Flow

Free Cash Flow Fcf Most Important Metric In Finance Valuation

Cash Flow Forecast Template Xls 2017 Excel Xls Templates Cash Flow Excel Spreadsheets Templates Excel Spreadsheets

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

Cash Flow From Investing Activities Definition

Cash Flow Statement Financial Model Cash Flow Statement Cash Flow Accounting Services

Internal Rate Of Return Irr And Mirr Meaning Calculation And Use Cost Accounting Meant To Be Business Case

Financial Report Template Free Is Very Necessary When Approaching To Professional Financial Management Or Profes Financial Management Report Template Financial

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)